What is a Limited Liability Company (LLC)?

Description

A Limited Liability Company (“LLC”) is a separate legal entity that offers an alternative to partnerships and corporations by combining the corporate advantages of limited liability with the partnership advantage of pass-through taxation. An LLC is created and comes into existence when articles of organization are filed with the proscribed fees, and accepted by the proper state authority.

Structure

An LLC is owned by its members. The members of an LLC are like partners in a partnership or shareholders of a corporation. A member will more closely resemble a shareholder if the LLC utilizes a manager or managers, because under that situation the members will not participate in the management of the LLC. However, if the LLC does not utilize managers, then the members will more closely resemble partners because they will have decision making powers in the LLC.

The member’s ownership in the LLC is represented by their respective “membership interest”, in the same manner as a partner has an “interest” in a partnership or a shareholder has stock in corporation.

Number of Members: Most states require LLC’s to have at least two members. The states which allow one member LLC’s are: DE, ID, MO, MN, NY, TX and VT.

Advantages

Taxation: Pass-Through Taxation LLC’s allow for pass-through taxation, allowing earnings of an LLC to be taxed only once. The earnings from an LLC are treated in a similar manner as earnings from a partnership, sole proprietorship and most S corporation.

Limited Liability: The member’s liability is generally limited to the amount of money which the member invested in the LLC. As a result, the members of an LLC receive the same limited liability protection as do shareholders of a corporation.

Flexible Organizational Structure: LLC’s are generally free to establish any organizational structure agreed upon by its members. Thus, profit interests may be separated from voting interests.

In general, the disadvantages of either entity might include:

- Complexity and expense of forming a corporation or LLC.

- Legal formalities involved with running a corporation or an LLC

Limitations

- Possibility of losing pass-through taxation if the LLC is not properly structured.

- More paperwork than an ordinary partnership.

Management

An LLC is owned by its members. The members of an LLC are like partners in a partnership or shareholders of a corporation. If the LLC is managed by its members, then it operates much like a partnership. Each member shares equally in the decision making process of the LLC.

Alternatively, the members may choose to appoint a manager or managers to act in a capacity similar to a corporation’s board of directors.

The managers are then in charge of the business affairs of the LLC. If managers are not designated in the articles of organization, the members will be deemed to direct the business affairs of the LLC.

A member will more closely resemble a shareholder if the LLC utilizes a manager or managers, because under that situation the members will not participate in the management of the LLC. However, if the LLC does not utilize managers, then the members will more closely resemble partners because they will have decision making powers in the LLC.

Frequently asked questions about Limited Liability Companies (LLC)

What are the Disadvantages of an LLC?

The possibility of losing pass-through taxation if the LLC is not properly structured.

More paperwork and documentation is needed than in an ordinary partnership.

Do I need an Attorney to form an LLC?

No, an attorney is not a legal requirement of forming an LLC. However, certain knowledge is necessary in order to properly file the required documentation in the designated state.

You can use our guaranteed services to form your LLC, and save a substantial amount of money you would otherwise pay an attorney. However, if you need legal or financial advice as to the type of entity which would best suit your business needs, consult your attorney or financial advisor.

How many people are needed to form an LLC?

An LLC must have at least one member in all states except Massachusetts, where a minimum of two members is required.

How is an LLC Managed?

An LLC is managed by its members or by selected managers.

If the LLC is managed by its members, it operates much like a partnership. Each member shares equally in the decision making process of the LLC.

Alternatively, the members may choose to appoint a manager or managers to act in a capacity similar to a corporation’s board of directors. The managers are in charge of the business affairs of the LLC.

If managers are not designated in the articles of organization, the members will be deemed to direct the business affairs of the LLC.

What is a Registered Agent and is one needed?

In all states, an individual or service company must be responsible for receiving important legal and tax documents. This service is provided by an “agent” of the LLC who is “registered” with the state of incorporation. Thus, the term “Registered Agent.” The registered agent must have a valid street address within the state of formation, and be available during normal business hours to receive documents.

The services performed by a registered agent may include:

- Receiving and forwarding legal documents.

- Receiving and forwarding franchise tax and annual report forms.

- Accepting and forwarding service of process.

Should I choose an LLC or an S Corporation?

The status of an S Corporation provides the elimination of double taxation. However, the S Corporation does not have the flexibility of an LLC in regard to the allocation of income to its members.

An LLC may have an unlimited number of members. However, ownership in an S Corporation is limited to no more than 75 shareholders. Further, an S Corporation cannot have shareholders who are C Corporations, other S Corporations, certain trusts, LLC’s, partnerships or nonresident aliens.

LLC’s are permitted to own subsidiaries without restriction, while S Corporations are not allowed to own 80% or more of another corporation’s shares.

How can I structure an LLC to achieve pass-through taxation?

If an LLC wants to take advantage of pass-through taxation, it must meet certain requirements which have been established. To have pass-through taxation an LLC may not have more than two of the following characteristics of a corporation:

- Limited Liability

- Unlimited Life

- Free Transferability of Interest

- Centralized Management

How do I get my LLC online?

In order to launch your business, you will need to get a business phone number, email address, and website. Our service automatically comes with our Business Identity Package. Clients get to choose a domain name, an email address at that domain, a business website, and get an SSL certificate. You can also choose a phone number for your business with virtual phone service that allows you to use this direct line with an internet connection or our iOS or Android apps.

What is an LLC Kit?

Once an LLC has been legally formed and is ready to complete its organization, it will require an “LLC Kit” to complete its Operating Agreement, maintain certain of its required records, and to facilitate distribution of membership certificates.

The LLC Kit will include:

- LLC Seal

- Operating Agreement

- Membership Certificates

- Book/Binder

- Miscellaneous Forms

A LLC Seal is a small press into which a document is placed to be embossed. The imprint made by the seal indicates the LLC’s name, state of formation and date of formation. An impression made by an LLC seal helps to conveys the mark of authority upon business documents.

A Membership Certificate is a printed document used to indicate ownership interest in an LLC. The LLC Kit supplied by Form-A-Corp contains custom-printed membership certificates which may be issued at the discretion of the LLC.

What is a Federal Employer Identification Number?

Once the LLC has been formed and is ready to do business, it is the time to apply for a federal employer identification number (EIN). Generally, any LLC doing business within the U.S. is required to have an EIN. In fact, the EIN is necessary when filing tax returns and for establishing bank accounts.

A LLC can receive an EIN by completing and submitting IRS Form SS-4. However, you can have Form-A-Corp save you this tedious and time consuming paperwork by completing and submitting the necessary EIN form on your behalf.

How do I begin the process of forming an LLC for my business?

Once you have decided the type of business entity which is best for your business, articles of organization must be filed with the proper state agency together with certain fees.

Form-A-Corp will provide all necessary services to ensure that the administrative processes are completed in the shortest period of time, with the highest degree of skill and efficiency, and at the lowest cost.

After the articles of organization are filed and accepted by the designated state, your LLC must hold an organizational meeting and adopt a proper Operating Agreement. The necessary Operating Agreement recording material, LLC seal and membership certificates are all included in Form-A-Corp’s LLC Kit.

What is a DBA, Fictitious Name, Tradename?

The phrase “doing business as” (abbreviated DBA, dba, d.b.a. or d/b/a) is a legal term used in the United States and Canada, meaning that the trade name, or fictitious business name, under which the business or operation is conducted and presented to the world is not the legal name of the legal person(s) who actually owns the business and is responsible for it.

The distinction between an actual and a “fictitious” name is important because businesses with “fictitious” names give no obvious indication of the entity that is legally responsible for their operation. Fictitious names do not create legal entities in and of themselves; they are merely names assumed by existing persons or entities. In some jurisdictions, when a businessperson writes a trade name on a contract, invoice, or check, he or she must also add the legal name of the business.

Lots of companies operate under a trade name (DBA) because it allows for franchising and branding opportunities. If you’re interested in registering a trade name, select our Trade Name Service inside your account after signing up for our business formation service. We will register your company’s trade name for $125 plus state fees.

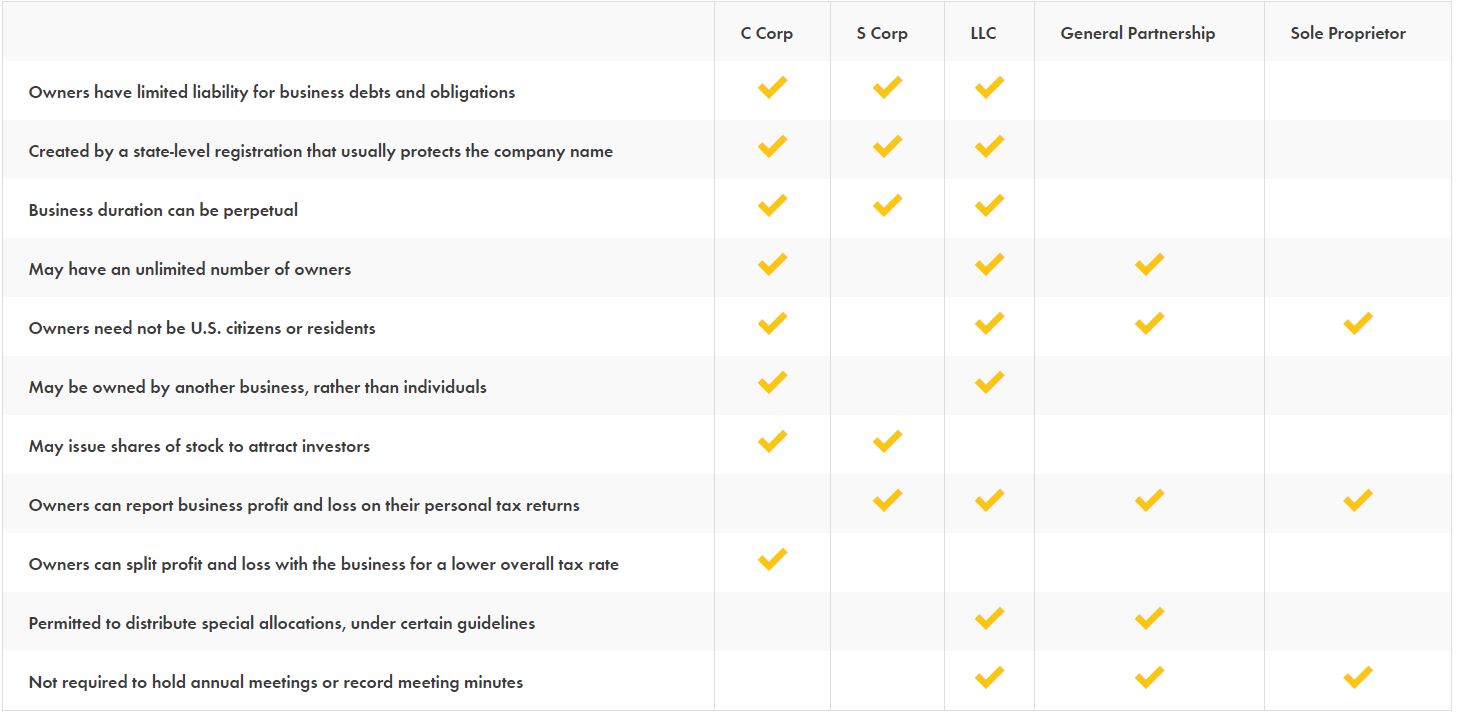

Entity Comparison Chart